ten Better Internet casino Real cash Websites inside the forest band step 1 put 2025 the usa away from the usa to possess 2025

Launch The newest Kraken Slot Remark 2025 100 percent free Enjoy cool wolf play Demo

March 11, 2025Top 10: Nachfolgende besten iPhone Kasino Echtgeld Apps 2025

March 11, 2025You will not end up being energized a charge while using an in-community Automatic teller machine, yet not, third-group charges obtain while using out-of-network ATMs are not at the mercy of reimbursement. SoFi’s Atm formula try subject to change during the all of our discernment at the any time. That is Alliant’s longest reputation offer plus it doesn’t need a primary deposit, but it does require that you generate transfers for the membership. That it render will come in La, New york, Sc, Texas, TN, AR, MS, AL, GA, KY, Fl, NC and Virtual assistant. There’s a 2 fee every month however, easily waived for those who choose electronic comments and you ought to secure the account discover for half dozen months or you forfeit the advantage.

Very first Views features an extremely effortless give where you can rating 450 for individuals who unlock a free account to make being qualified direct deposits totaling a lot of inside earliest 90 days.. A good qualifying buyer-initiated purchase covers numerous transactions, and dumps, inspections paid off, ACH issues, and you may trademark and you may PIN-dependent requests made with a primary Vista Debit Credit. Phase step 1 – Register PSECU by the clicking which link to check out the web site and you may signing up for them with the promo code RIGHTNOTE. After you’ve registered, include a totally free savings account (5 minimum put). Register and sign in electronic banking and set upwards a being qualified payroll head deposit(s) you to definitely overall at the least 500 per 30 days. Spotlight Financial is actually an online-merely lender one to’s a division from Financing Neighborhood Financial.

Finder survey: What label put provides perform Australians worth very?

An educated IRA cost was selected from profile requiring 50 otherwise shorter to open up. For the majority of of our kinds, we then simplified our very own research to only were accounts one to needed lower than a specific starting put amount. This type of associations are offering a knowledgeable IRA costs along the much time label. Within this class, “harmony maximum” form the best matter your’ll secure one to interest to your. You could continue to make some desire for the quantity above one, nonetheless it’s typically from the less interest rate.

- Well-known Lead also provides Cds within the eight words anywhere between three months so you can five years.

- Funding You to definitely 360 Results Savings inspections the packets i lookup for inside a top-yield bank account.

- Series We bond purchases are simply for 15,100000 for every individual, per year.

- First, you’ll must open a free account in the lender where we would like to score a good Cd.

- The best standard checking costs were chose from membership requiring one hundred otherwise reduced to open up, reduced or no fee every month, without highest-equilibrium standards.

Both banking institutions can get sly so learn the laws and regulations out of what you will want to make certain they don’t hose you. The newest Flagstar In a position Savings tick this link here now account needs a good 50 lowest deposit to open up the brand new account but there is however no lowest harmony specifications. It offers zero month-to-month maintenance commission after you enroll in elizabeth-statements. Your qualify for the advantage for those who have a couple (2) Increased Head Deposits in to your checking account within 90 diary days from account opening.

Complete Self-help guide to step 1-12 months Cd Prices

Our very own point is always to manage a well-balanced checklist presenting better-rating points of credible brands giving competitive APYs and you can standout has. Marcus because of the Goldman Sachs provides a bonus on the on the internet checking account – they’ll give you 100 after you deposit ten,000 or maybe more inside the brand new financing on the a different otherwise present Online Family savings within this ten days of subscription. Dated Federal Financial provides a couple of also offers readily available and also the amount of the main benefit utilizes the complete of dos+ head places made over ninety days. The brand new Flagstar Elite Checking account in addition to demands a 50 lowest deposit to open up the new account but there’s zero lowest balance requirements. It can, however, have a great 15 monthly fix commission that is just waived for many who take care of a good twenty five,100 combined monthly mediocre equilibrium throughout of your deposit profile. Even when inside the April 2020, there is a keen meantime latest signal in order to amend Control D and erase the fresh restriction for the particular withdrawals, really deals and money business profile have these types of restrictions.

And get acquainted with very early withdrawal charges to prevent possibly losing currency. Even though factoring inside current price minimizes, competitive Computer game costs remain more than the new national average Cd prices. What’s more, high-producing Video game costs always outpace the speed from rising prices. Checking profile are ideal for those who need to continue its money safe when you are nevertheless with simple, day-to-time use of their cash. If you’re a number one roller or just playing excitement, real time broker game render a passionate immersive and you will personal betting getting you to definitely’s difficult to defeat.

So if you want effortless access to your finances, then an expression put may not be most effective for you. Financing You to definitely also provides Cds with conditions while the quick while the six months otherwise for as long as five years. Such Cds haven’t any lowest starting deposit and also the lender offers competitive production. The united states Earliest Borrowing from the bank Relationship now offers a variety of Computer game words anywhere between around three and 60 days, and all of earn prices which can be extremely aggressive. And provided is actually expertise Dvds such a bump-price Computer game and you will a flexible Video game. Cds are ideal for someone searching for a guaranteed rate away from come back one to’s typically more than a savings account.

Bump-right up Dvds allow you to demand a performance improve through the a great Computer game’s identity, so long as the bank raises the rate for the recently given bump-upwards Dvds. Which cheer will come in convenient throughout the a rising-rate ecosystem, however, whether or not rates slide, you might nevertheless secure a good price. Cds features typically offered a few of the highest protected productivity one of bank account, but you to definitely doesn’t automatically make them an informed family for the deals or investments.

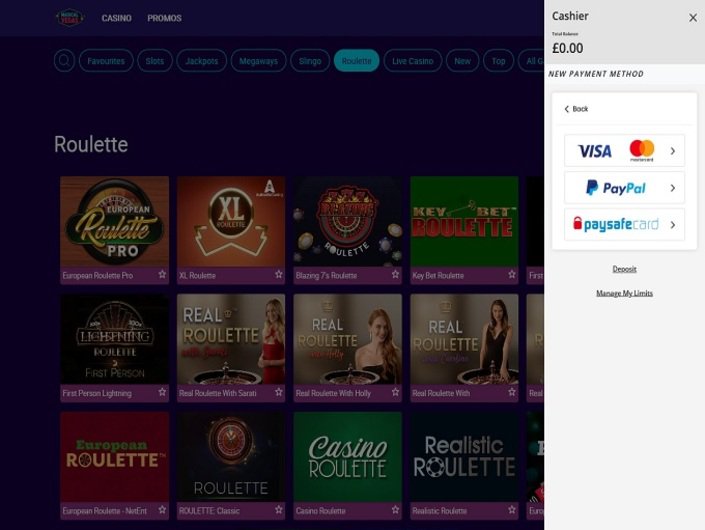

Playing Online

A phrase put is the most suitable suitable for people that currently have some money saved and therefore are in a position to put it out and you may perhaps not reach they for some time. Thenew regulations slices the number of preservation software of 23 to 13, whilestill keeping all rewarding maintenance and you can forestry methods availablein the newest previous. For example, the new Animals Habitat Bonuses Program (WHIP) wascombined for the Environment Top quality Bonuses Program (EQIP). If you are thismeans you�ll not create WHIP contracts, you can still find dedicatedwildlife tips inside EQIP�definition your creatures administration requirements try stilljust as the relevant and only as essential. Consider the pros and you can disadvantages of Computer game membership to decide if the so it deals strategy is most effective for you. Synchrony Bank offers of numerous normal Cds anywhere between three months to help you five years.

You could potentially transfer the funds to the other PenFed account, move it on the an alternative certificate, rating a great sent consider or transfer they through ACH. You could potentially take control of your certificate account online or thru cellular software. You can become an excellent Bethpage Federal Borrowing from the bank Partnership associate by simply making an excellent 5 put for the a great Bethpage family savings. To get more about how exactly i choose the best cost, comprehend our very own complete strategy. If you include an excellent Video game on the IRA, you will possibly not have to pay fees up to you might be willing to withdraw inside old age. Which have an excellent Roth IRA, you’re not punished to have withdrawing funds from the fresh account if it’s discover for around 5 years because it is funded which have after-income tax bucks.

Would you generate losses for the a good Computer game?

All of our finest Cd costs derive from careful lookup, and now we modify this information the weekday to deliver the newest best Cd costs available across the country. EverBank Efficiency℠ Offers have among the greatest APYs for the our family savings radar, particularly among account that want zero minimum deposit. There are not any maintenance fees, and there is numerous alternatives for making dumps for the membership. To possess consumers who happen to live within the Fl, there are a few physical where you can check out. Better, all the large yield offers account i encourage with this web page are utilized individually from the our very own personnel only at The brand new Motley Deceive, along with myself (find our very own very first-give analysis lower than). Next, create 1000 or maybe more out of qualifying ACH lead places into the account that must article within this 3 months out of membership opening.

Finest step 1-seasons Video game cost from February 2025

People Accessibility produced their debut inside 2018 and will be offering four conditions out of Cds that every want at the least a good 5,100000 deposit. In the event you wear’t have 5,100000 to have a good Computer game, Citizens Accessibility’ checking account simply requires a 1 cent lowest deposit. Bankrate score are fairly influenced by our very own article people. Annual commission production (APYs), minimum opening deposit criteria and you will lowest balance to avoid monthly solution charges are some of the issues that compensate Bankrate’s rating.